Tips for Buying a Car in Towson, MD

If you are in the market for a new or used car, perhaps you think that finding a quality vehicle that fits your budget right now is an impossible task. Although the current vehicle inventory is low, it’s still possible to find a great vehicle right in Towson, MD and the surrounding Baltimore metro area.

The following tips for buying a car in Towson, MD, can help you find the best car for your needs. They can also save you time and money, all while making your car shopping experience pleasant and productive.

Know How Much Car You Can Afford

When many people shop for a new car, they often don’t consider how much they can afford. This could be a mistake that could cause you to spend more time than necessary when shopping.

How much should you spend on a new car?

A good rule of thumb is that your monthly car payments should never be more than 20% of your monthly income. Less is better. It’s also important to keep in mind that your car payment won’t be your only expense. You will also need to factor in the cost of insurance, fuel, oil changes, tires, and other things.

Your down payment is another consideration. The higher your down payment, the lower your monthly car payments will be.

Get Pre-Approved for a Loan

You have several choices when it comes to financing a car. Dealership financing is a popular option, but it may not be the best deal. Some dealerships add additional interest over the interest charged by the financiers they work with to increase their profits.

Online lenders are another option, although they often have high interest rates. Also, if you have a question or concern, you may have difficulty getting answers. You may be limited to communicating either by email or online chat.

If you are looking for the best financing deal, credit unions usually offer the lowest interest rates. Credit unions are nonprofit organizations that are primarily concerned with taking care of their members instead of earning a profit for their shareholders, like with banks.

Once you have selected a private lender, you can apply for pre-approval. Pre-approval is not the same as being approved for a loan. With pre-approval, a lender reviews your financial situation and tells you how much they are willing to lend you. This helps you narrow your choices when shopping so you can avoid the cars you know you can’t afford. It helps you save time.

Shop Online to Save Time

Most car dealerships now have websites that list all of their current inventory. Instead of driving from one dealership to another to see what they have, you can check out their cars online. This allows you to pick out the cars you think you might be interested in and then visit the dealerships to see them in person.

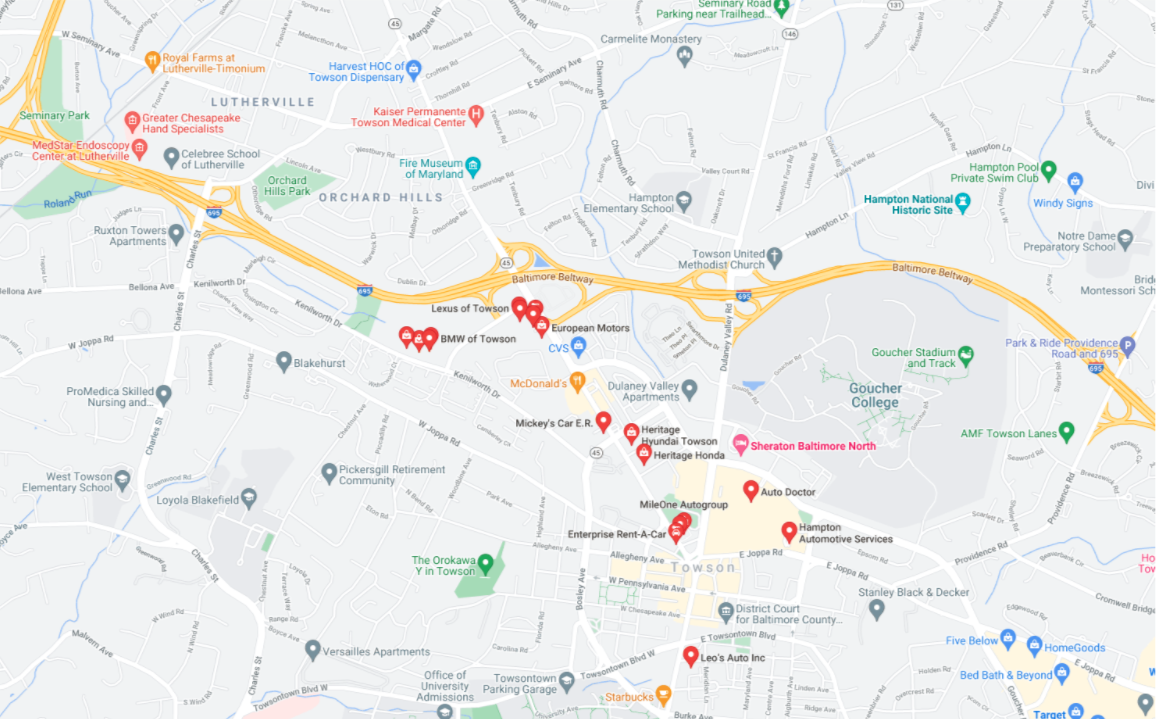

Most dealerships in the Towson area are located off of the Baltimore Beltway or along York Road. This makes visiting dealerships and test driving the cars you picked out online very easy and convenient. You can go either north or south on York Road, for example, and then head over to Kenilworth Drive off of I-695 to visit the other dealerships.

You can see in the following map how close all of the dealerships are to each other:

The following is a list of dealerships off of York Road and the Baltimore Beltway I-695. You can use the links to check out each dealership’s inventory online to find cars that meet your needs and budget.

Off of York Rd.

725 York Rd, Towson, MD 21204

801 York Rd, Towson, MD 21204

801 York Rd, Towson, MD 21204

1040 York Rd, Towson, MD 21204

1630 York Rd, Towson, MD 21093

Off Baltimore Beltway I-695

720 Kenilworth Dr. Suite A, Towson, MD 21204

700 Kenilworth Dr. Suite 1, Towson, MD 21204

700 Kenilworth Dr, Towson, MD 21204

Before you visit dealerships, it’s worthwhile to call them first to verify that they still have the cars you are interested in. Due to the current inventory shortage, many dealerships are selling trade-ins the same day they get them. They sometimes don’t even have time to detail cars and display them on their lots. A quick phone call could save you time and trouble if a car has already been sold.

Buying a Used Car

Many people prefer to buy gently used cars with low miles because they are often much more affordable than newer ones and still have the majority of their useful lives remaining. There are some important things to consider, however, to make sure any used car you buy is reliable.

Research Brand Reliability

Some car brands are more reliable than others. To make sure you buy a used car that will last a long time, it’s a good idea to research brand reliability before making a buying decision. Be sure to read product review websites and check with mechanics to see which brands they prefer.

Check Out the Vehicle History Report

After finding a car you are interested in, ask the dealership to give you a copy of the vehicle history report from either Carfax or AutoCheck. These reports will tell you detailed information about the car’s title, accident history, maintenance history, and other things.

Go for a Test Drive

It’s always recommended that you go for a test drive to make sure the car performs as expected before you buy it. A test drive can reveal things about the engine, transmission, ride quality, and other things that you couldn’t have known about while it was parked.

Have a Mechanic Inspect It

Before you buy any vehicle, be sure to have a mechanic inspect it first. This is something you can do while you are test driving it. If the car has any mechanical problems, a good mechanic will find them and tell you what needs to be fixed.

Make Your Offer as Soon as Possible

When you find a vehicle you want to buy, it’s important to make an offer as soon as possible if the dealership has limited inventory. Someone else may buy it if you don’t act fast.

Before you make an offer, it’s also wise to research the market value for the make and model you want to buy. This will give you negotiating leverage that you can use to get a great deal.

Get Pre-Approved to Buy a Car in Towson, MD Today

If you are in the market for a new or used car in the Towson, MD area, Atlantic Financial FCU offers car loans with low interest rates and flexible terms. Applying is easy, and you can do it either online or in person. Check out the following link to learn more about our auto loans.