Digital Banking Upgrade

Your New & Improved Digital Banking Experience Is Here

A BETTER DIGITAL BANKING EXPERIENCE

We strive to ensure an exceptional member experience is delivered across every banking channel. With a steady increase in the use of our digital banking tools, it is our commitment to ensure we continue to develop and evolve this channel to better serve you.

We’re excited to provide you with our new and improved digital banking experience.

Seamless Experience

Do more on any device. Our new platform will deliver a consistent experience across online/desktop and mobile app to allow nearly identical features and functionality no matter how, when, or where you need to access your account.

Enhanced Functionality

Improved information delivery and navigation. Our new platform will deliver enhanced features and functionality no matter how, when, or where you need to access your account. Advanced functions include the introduction of a smartwatch app and digital voice banking (using Alexa enabled devices).

Continuing Evolution

The new platform will allow us to more rapidly integrate and launch new tools and features to make it easier to manage your accounts. Our digital banking roadmap will continue to evolve with new banking features and functionality.

What To Know

We are working to ensure a seamless digital transition and want to help you be prepared. Our new digital banking platform launched on March 15, 2021.

Information To Have & Update:

- To setup access you will need to have your Member Number, Social Security Number (last 5-digits), and your date of birth. Please ensure you have your 7-digit AFFCU member number.

- Ensure we have your latest information in our system including email, cell phone, and home phone which will be used to issue and validate one-time passcodes for setup.

Finding Your Member Number

Not Sure About Your Member Number?

No worries. There are two ways we help you find it.

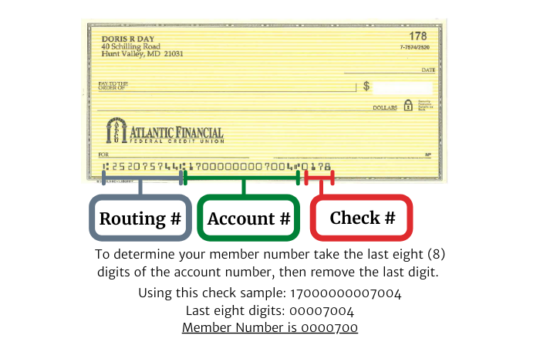

Using Your AFFCU Checks

Look at your AFFCU checks as depicted in the image. Take the last eight-digits of the displayed full account number. Then remove the last number to identify your proper seven-digit member number.

Using Your Current Online Banking Account

The same method can be used by accessing your current AFFCU online banking account. After logging in, go to “Account Access” tab and either under “My E-Branch” or “Accounts” you will find your deposit accounts listed. Find either your Primary Savings or Checking account. At the end of the row select “Info or Account Information.” At the bottom of the information you will find the 14-digit “Full Share Acct Number.” Follow the same instructions to decipher your 7-digit member number.

Omni-Channel Digital Banking

Our new digital banking platform will provide omni-channel access. Manage your AFFCU accounts from a growing platform of digital channels. Online, mobile, text, smart watch, and voice. However you prefer, we’re making it easier and more convenient to access and manage your AFFCU accounts.

Digital Banking Highlights

Our new digital banking platform will provide the same key features and functionality, but with an enhanced user experience. Improved site navigation, enhanced features, upgraded security, and more.

Unique Enhancements:

- Multi-account access – Access all of your jointed and connected accounts through one login. Individual access for each joint owner (no shared credentials)

- Member to member transfers

- Quick balance sneak peak (Mobile app)

- Improved alerts and notifications

- Enhanced mobile banking capabilities

We’re making it easier and more convenient to access and manage your AFFCU accounts.

Member Support - Frequently Asked Questions

We’ve taken every effort to ensure a seamless transition from our old platform to the new digital banking system. However, we know change can sometimes be disruptive and uneasy. So to provide member support, we’ve compiled a list of frequently asked questions for members to reference.

Below are some general questions related to the digital banking conversion. We’ve develop a more comprehensive Digital Banking Support page to answer some more common questions and provide you support through this new experience.

General Upgrade FAQs

Your digital banking activities will remain uninterrupted until we initiate the conversion process. You can continue normal digital banking activities.

Keep an eye on this page, where we will post updates and pertinent information. We’ll also be sending updates and notifications via email and sharing through our social channels.

Other things you can do right now:

- Update your contact information with us so we can connect with you about these important changes.

- Take a look at your accounts and who has access to them. Make any access changes now so your Digital Branch experience is what you expect.

- Know what transfers, bill payments, and eBills you currently have set up so you can ensure they all transfer correctly, or re-set up the ones that need to be reconnected. Don’t enroll any new eBills as those will not convert over.

- Get familiar with our key dates, as these impact your ability to update your account, and make one-time transfers and bill payments.

AFFCU is dedicated to providing technology that helps our members better manage their personal finances. We have initiated this change in order to better evolve with the rapidly changing digital channels and provide members with an improved experience compared to what we offer today. To continue our commitment to offering enhanced technology and security to our members, it’s important that we upgrade to a system that can bring you a robust online banking experience to fit your needs.

This upgrade brings you a more streamlined, easy-to-use interface. A more robust platform will allow us to continue to evolve to meet the changing digital demands and do so at a faster pace. Updated multifactor authentication and passcodes offer the best security for your peace of mind. The change will also provide a more balanced experience providing nearly the same functionality no matter how you access your digital account.

We will convert to our new Digital Banking platform on March 15, 2021.

Other important dates to note are:

- March 12: Last day accessing current system (at 6:00 PM ET).

- March 13 -14: All current digital banking access will be frozen as we migrate data and activity. (Note: Access will be unavailable during these dates, but any scheduled activity will be processed.)

Everything except your account information. A key difference is that most everything you can do on the online platform can now be done on the mobile app, providing a seamless banking experience across all methods of access.

Our core services and features you are familiar with like Bill Pay, transferring funds, account alerts, and remote check deposit will remain available. These features will be easier to use, more intuitive, and offer more value to you.

The overall look and feel of online banking will change. The desktop and mobile versions of online banking will be more similar and you’ll be able to do nearly everything from your phone you can do from a desktop computer. The technology will be updated much more regularly allowing us to stay current with the latest digital banking technology trends.

In addition, the accounts you will be able to view may be different. The new Digital Branch is built around you. This means that whoever logs in will see accounts and loans associated with the unique identifier of the primary account owner under that single login. If you log in like you’re accustomed to doing, you may see more accounts or loans than have been visible to you before. No more logging into several accounts.

We recommend that you take the time to make sure you know which accounts will be visible to you, and which accounts of yours may be visible to others once we flip the switch. If you have any questions or concerns, reach out to our Member Contact Center at (410) 584-7474.

No. Your membership number and account numbers will remain the same. If your full membership number is 10000012345678, you will enter 1234567 (take the last 8 numbers and remove the last digit which is a share identifier – may include zeros at the beginning if applicable) when enrolling in Digital Banking. If you do not know your account number, it can be found on the bottom of your checks or you can call (410) 584-7474 for help.

We strongly encourage you to confirm this piece of information in advance and have knowledge of it when accessing the new system for the first time

Yes. You will want to delete the old AFFCU Mobile Banking App and download the new version to your mobile device(s). You can find it by searching AFFCU in the App Store or GooglePlay Marketplace, or simply follow the links posted on this page.

Member Digital Support Resources

Digital Banking FAQ's

Review more Frequently Asked Questions compiled to help guide you through the new digital banking system.

Digital Banking FAQsHow To Videos

View some of our step-by-step how to videos for accessing your account in the new digital banking system.

Digital Banking Videos