Managing Your Personal Records: What To Keep vs. Destroy

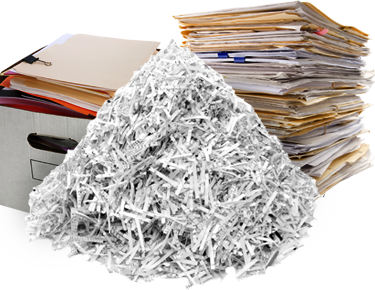

With tax season wrapping up and your spring cleaning likely beginning, you may have the urge to purge paperwork, files and personal records. While it is tempting to get rid of all the files and clutter, it is best to keep some documents for the recommended records retention schedule.

Here are some helpful tips for managing your secure financial and personal documents. And remember, review what you throw out. To best protect yourself from identity theft be sure to securely destroy any materials that contain personal information, social security numbers, or account numbers.

Securely Destroy Them At AFFCU’s Shred Day

AFFCU will be hosting a FREE shred event at the Hunt Valley location. Join us for secure, on-site shredding of your personal, confidential documents. All materials will be securely shredded on-site.

Saturday, October 5, 2019

Hunt Valley Branch (40 Schilling Rd)

9:00AM – 12:00PM (noon)

Drop-offs should be limited to approximately four (4) medium boxes or bags per member. We cannot accept large car/truckloads of materials or business account files/documents. Shred service will be provided until 12:00 pm (noon) or until the truck reaches capacity, whichever comes first.

How Long To Keep Financial Records

The following are suggestions about how long you should keep personal finance and investment records on file. You should safely store or electronically scan and save certain essential documents.

Taxes:

Returns; Canceled checks/receipts (alimony, charitable contributions, mortgage interest and retirement plan contributions); Records for tax deductions taken

Seven years

- The IRS has three years from your filing date to audit your return if it suspects good-faith errors.

- The three-year deadline also applies if you discover a mistake in your return and decide to file an amended return to claim a refund.

- The IRS has six years to challenge your return if it thinks you underreported your gross income by 25 percent or more.

- There is no time limit if you failed to file your return or filed a fraudulent return.

IRA contribution records

Permanently: If you made a nondeductible contribution to an IRA, keep the records indefinitely to prove that you already paid tax on this money when the time comes to withdraw.

Retirement savings plan statements

From one year to permanently

- Keep the quarterly statements from your 401(k) or other plans until you receive the annual summary; if everything matches up, then shred the quarterlies.

- Keep the annual summaries until you retire or close the account.

Bank records

From one year to permanently

- Go through your checks each year and keep those related to your taxes, business expenses, home improvements and mortgage payments.

- Shred those that have no long-term importance.

Brokerage statements

Until you sell the securities

You need the purchase or sales slips from your brokerage or mutual fund to prove whether you have capital gains or losses at tax time.

Bills

From one year to permanently

- Go through your bills once a year.

- In most cases, when the canceled check from a paid bill has been returned, you can shred the bill.

- However, bills for big purchases — such as jewelry, rugs, appliances, antiques, cars, collectibles, furniture, computers, etc. — should be kept in an insurance file for proof of their value in the event of loss or damage.

Credit card receipts and statements

From 45 days to seven years

- Keep your original receipts until you get your monthly statement; shred the receipts if the two match up.

- Keep the statements for seven years if tax-related expenses are documented.

Paycheck stubs

One year

- When you receive your annual W-2 form from your employer, make sure the information on your stubs matches.

- If it does, shred the stubs.

- If it doesn’t, demand a corrected form, known as a W-2c.

House/condominium records

From six years to permanently

- Keep all records documenting the purchase price and the cost of all permanent improvements — such as remodeling, additions and installations.

- Keep records of expenses incurred in selling and buying the property, such as legal fees and your real estate agent’s commission, for six years after you sell your home.

- Holding on to these records is important because any improvements you make on your house, as well as expenses in selling it, are added to the original purchase price or cost basis. This adds up to a greater profit (also known as capital gains) when you sell your house. Therefore, you lower your capital gains tax.