COVID-19 Stimulus Payments

Helpful Information Regarding The COVID-19 Stimulus Payments

What To Know About The COVID-19 Stimulus Payments

A major component of the governments recently enacted CARES Act, is the payment of stimulus checks. As new information surrounding the federal stimulus payments is available, the I.R.S. website is posting regular updates. We encourage you to review this resource for the most complete details, but we have highlighted some facts about stimulus payments below.

How Much Will I Recieve?

The average American will receive $1,200 ($2,400 for couples) plus $500 for every child 17 and under.

When Will I receive It?

The first batch of stimulus payments is targeted to post effective April 15. After this initial batch, the Treasury will continue to issue the payments every Friday.

What To Do With It?

What you use your stimulus check for is up to you. Pay your bills, save for future, use it how you need to.

Stimulus Payment Guidance

AFFCU members who receive direct deposit to their account have a unique advantage. Similar to normal payroll direct deposits, the CARES Act stimulus checks will be credited to your accounts a day in advance of their scheduled posting date.

Monitor your accounts via AFFCU online and mobile banking. Individuals will receive their payments at different times based on the IRS processing. The first payments will be delivered April 15 (AFFCU direct deposit members will receive April 14). Payments will then be made every Friday thereafter.

What you do with the payment you receive is totally up to you. The intention is to help stimulate the U.S. economy and support the citizens by giving support to make necessary payments.

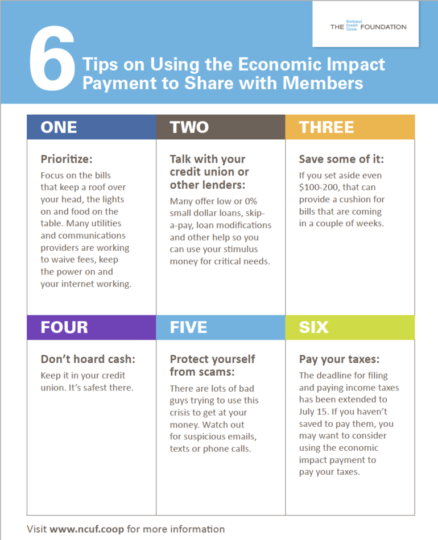

- Prioritize: Focus on the bills that keep a roof over your head, the lights on and food on the table.

- Save some of it: If you set aside even $100-200, that can provide a cushion for bills that are coming in a couple of weeks.

- Don’t hoard cash: Keep it in your Atlantic Financial Federal Credit Union account where it is safe and insured.

- Pay your taxes: The deadline for filing and paying income taxes has been extended to July 15th. If you haven’t saved to pay your income taxes, you may want to consider using the economic impact payment to pay your taxes.

Here are the six things from our partners at the National Credit Union Foundation that you can do related to your stimulus check to support your financial health and well-being during this difficult time.

Protect Yourself & The Community

As we continue to stress, during this time of crisis, scammers and thieves prey on members of our communities in an attempt to personally benefit by stealing their money and personal identifying information. Please help us protect everyone in your community by telling family, friends and elderly neighbors to be on the lookout for these potential scams.

Scammers may try to get you to sign over your check to them or get you to “verify” your filing information in order to steal your money. Your personal information could then be used to file false tax returns in an identity theft scheme. Because of this, everyone receiving a COVID-19 economic impact payment is at risk.

The IRS and U.S. Attorney have provided helpful information and tips to spot a scam and understand how the COVID-19 related economic impact payments will be issued. Review this helpful information by visiting the IRS website.

Stimulus Payment FAQ's

Payouts will vary with most adults getting a one-time payment of $1,200. Actual payment depends on your annual income reported to the IRS.

- Single adults with Social Security numbers who have an adjusted gross income of $75,000 or less will get the full amount of $1,200.

- For every qualifying child age 16 or under, the payment will be an additional $500.

- Married couples with no children earning $150,000 or less will receive a total of $2,400.

- Taxpayers filing as head of household will get the full payment if they earned $112,500 or less.

- The payment amount decreases until it stops altogether for single people earning $99,000 or married people who have no children and earn $198,000.

- A family with two children will no longer be eligible for any payments if its income surpassed $218,000.

- You can’t get a payment if someone claims you as a dependent, even if you’re an adult.

- In any given family and in most instances, everyone must have a valid Social Security number in order to be eligible.

Your adjusted gross income is found on Line 8b of the 2019 1040 federal tax return.

For taxpayers who have previously filed electronically and for whom the IRS has their direct deposit information, it is estimated that between 50 million to 70 million Americans will receive their payments as early as April 15. The Treasury will continue to issue the payments every Friday following the initial batch on April 15.

People who haven’t provided their direct-deposit information to the IRS previously will likely face a longer wait, with paper checks slated to start being issued the week of May 4.

A benefit of being an AFFCU member is that you get your direct deposit credited a day early. So your electronic stimulus check deposit will post a day early, as soon as April 14, or on a Thursday following the IRS payment schedule.

People who haven’t provided their direct-deposit information to the IRS previously will likely face a longer wait, with paper checks slated to start being issued the week of May 4.

Printed checks will be issued at a rate of about 5 million per week, which means it could take up to 20 weeks to get all printed checks out. This means that some checks could be delayed until August or September.

Printed Checks will be prioritized and mailed by income level, with the lowest-income Americans receiving their checks the earliest

- Individual taxpayers who earn less than $10,000 would have their checks mailed on April 24,

- Those earning $20,000 or less would have their checks in the mail the following week, May 1.

- That would continue week by week through early September until completed.

The I.R.S. will launch Get My Payment in Mid-April which will allow you to:

- See the status of their payment.

- The date their check will be deposited or mailed.

- Allow people to provide their bank account information so they can receive their payment quicker rather than wait for a paper check.

You can also monitor your AFFCU account electronically through AFFCU’s online and mobile banking system. Preview your account transactions to see if a deposit from the IRS is credited to your account.

The IRS will use your 2019 income. If you haven’t prepared a tax return yet, you can use your 2018 return. If you haven’t filed that yet, you can use a 2019 Social Security statement showing your income to see what an employer reported to the I.R.S.

No. If you typically file taxes, the I.R.S. already has your bank account information from your 2019 or 2018 returns, it will transfer the money to you via direct deposit based on the recent income-tax figures it has on file.

However, if you typically DO NOT FILE TAXES, the I.R.S. launched a web tool for non-filers to register for their stimulus payment.

This new tool is designed for people who did not file a tax return for 2018 or 2019 and who don’t receive Social Security retirement, disability benefits, Railroad Retirement benefits, are low income, veterans, and other qualified groups.

The I.R.S. will launch Get My Payment in Mid-April that will allow you to:

- Allow people to provide their bank account information so they can receive their payment quicker rather than wait for a paper check. NOTE: The add bank account feature will be unavailable if the Economic Impact Payment has already been scheduled for delivery.

- See the status of their payment.

- The date their check will be deposited or mailed.

According to the CARES Act, you will get a paper notice in the mail no later than a few weeks after your payment has been disbursed. That notice will contain information about where the payment ended up and in what form it was made.

If you can’t locate your payment after receiving your printed payment notice, it recommended that you contact the I.R.S. using the information on the notice.

You can also visit the I.R.S. Get My Payment website that will launch in Mid-April for information to track your payment.